views

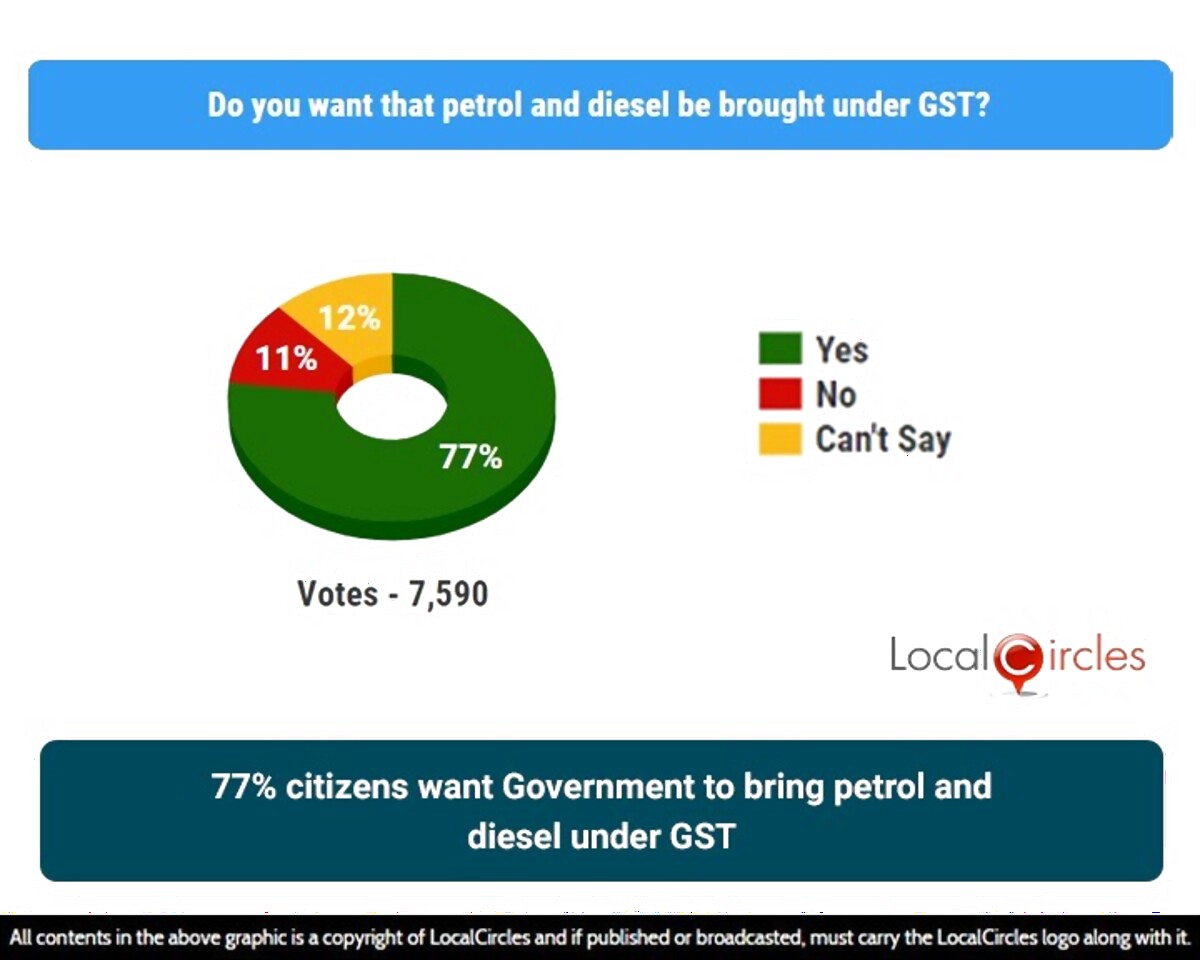

Ahead of the GST Council meeting in Lucknow on Friday, a survey has found that 77% citizens want the government to bring petrol and diesel under the Goods and Services Tax (GST) amidst the spiraling prices. According to reports, the GST Council might on Friday may consider taxing petrol, diesel and other petroleum products under the single national GST regime, a move that may require huge compromises by both central and state governments on the revenues they collect from taxing these products.

The Council, which comprises central and state finance ministers, is also likely to consider extending the time for duty relief on COVID-19 essentials, according to sources in the know of the development.

Responding to a question in a survey by LocalCircles, a social media platform, 77% citizens said that they want petrol and diesel be brought under the GST tier structure, 11% said it’s not needed, while 12% responded by saying “can’t say”.

The question received 7,590 responses from citizens located in 379 districts of India. 61% of the participants in the survey were men, while 39% were women. Of these, 44% of respondents were from tier 1 districts, 29% from tier 2 and 27% were from tier 3, 4 and rural districts.

The survey found that majority of the Indian households want petrol and diesel to be moved under GST as it will immediately have a huge positive impact on the cost of living.

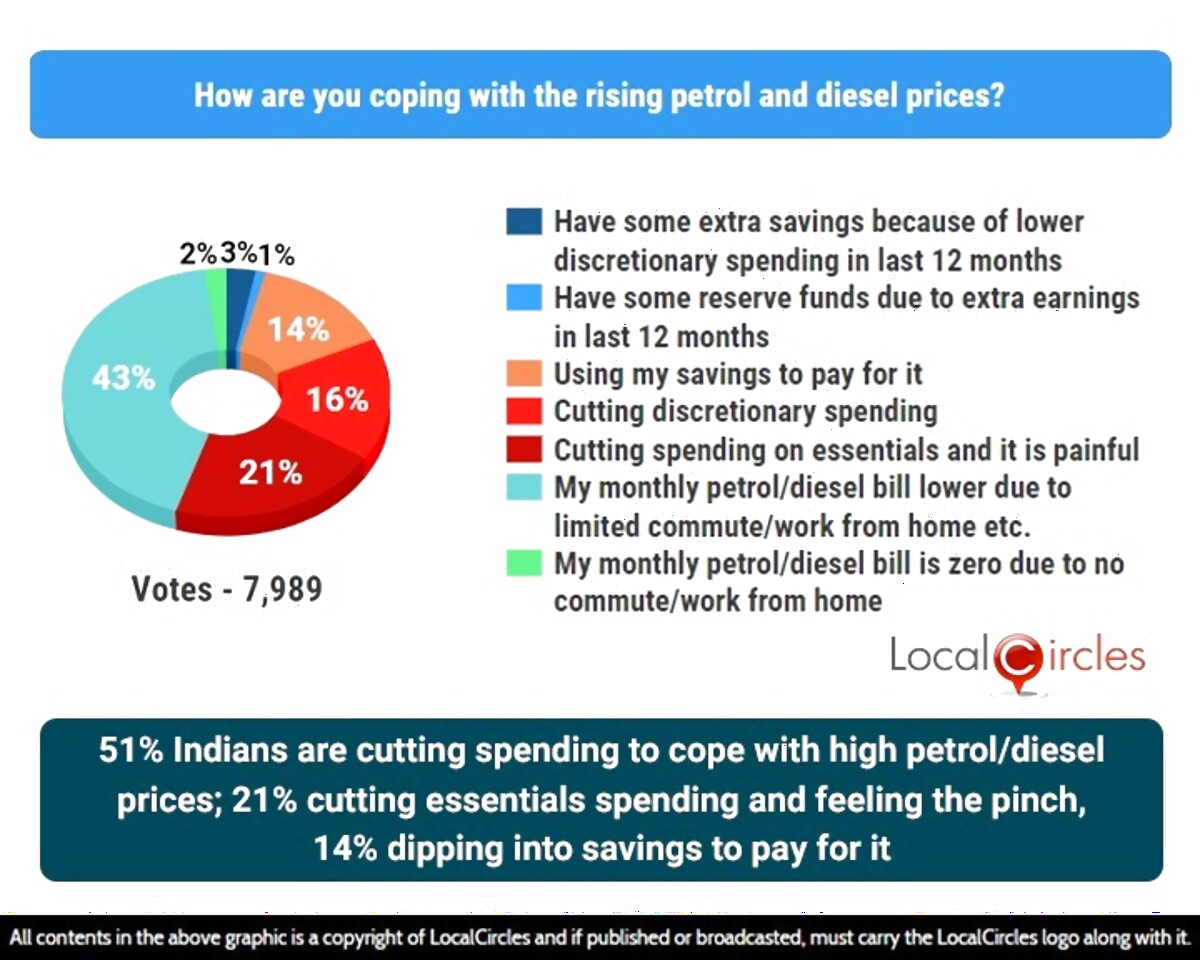

In a similar survey in the first half of 2021, at least 51% households had said that they have cut spending to cope with high petrol/diesel prices; 21% had even cut essentials spending and were feeling the pinch strongly while 14% expressed they were even dipping into savings to pay for it.

GST is a “single tax” applied all over India, with a set-off provision for tax paid on inputs. However, the constitutional amendment Act on GST, while providing for inclusion of crude oil, natural gas, petrol, diesel and aviation turbine fuel (ATF) under its ambit, had kept these products “zero-rated”.

Read all the Latest News , Breaking News and Ukraine-Russia War Live Updates here.

Comments

0 comment