views

The year-on-year growth rate in the adoption of maternity insurance plans has skyrocketed by an impressive 80%, reflecting the growing awareness and recognition of the importance of comprehensive maternity coverage, Policybazaar said in the latest data assessment.

“We’ve seen that the majority of customers buying maternity insurance fall within the 25 to 35 age bracket, comprising 91.2% of total buyers. This highlights a strong preference for maternity planning among young families,” Policybazaar shared in a statement.

Over the past year, there has been a significant surge in the adoption of maternity insurance, with 12.3% of the total health insurance customers choosing them, it added.

The platform has seen 78% of maternity plans purchased by men for their spouses, highlighting a growing trend of proactive family planning among couples. 22% of women are also opting to invest in maternity plans for themselves, demonstrating a shift towards individual empowerment in financial and healthcare decision-making.

When it comes to enhancing their coverage, customers are prioritising add-ons that provide maximum benefits. The top add-ons chosen by customers include consumables (38%), no room rent capping (33%), and no claim bonus (24%).

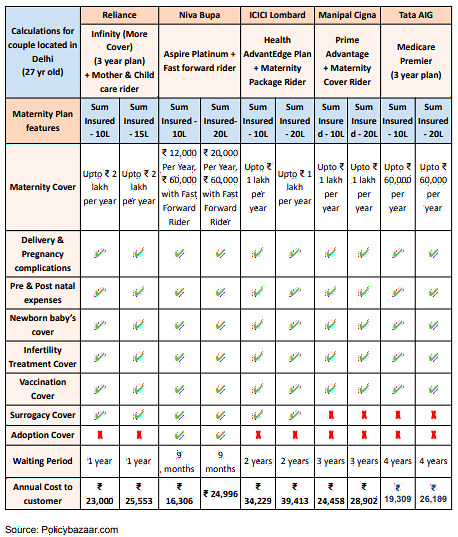

Policybazaar also shared a detailed comparison of maternity plans in the market for parents-to-be:

Maternity insurance in India

Maternity insurance is a specific type of health insurance policy designed to cover the medical expenses associated with pregnancy, childbirth, and newborn care. Here’s a breakdown of what it typically covers:

- Delivery charges: This includes expenses for both normal delivery and caesarean section (C-section).

- Hospitalisation costs: Maternity insurance covers hospital stay expenses during childbirth, including room charges, doctor’s fees, medication, and other related costs.

- Pre and postnatal care: Some plans cover expenses for doctor consultations, ultrasounds, and other diagnostic tests during pregnancy and after delivery.

- Newborn baby care: Certain maternity insurance plans offer coverage for the newborn baby’s medical expenses for a specific period after birth.

Maternity insurance can be a valuable tool for expecting parents, helping them manage the financial burden of childbirth and ensuring they can access quality healthcare during pregnancy and delivery. However, there are a few important things to keep in mind:

- Waiting period caution: Most insurance companies in India have a waiting period ranging from 9 months to 6 years before you can claim maternity benefits under the policy. This means you cannot get coverage for pregnancy-related expenses if you get pregnant within this period after purchasing the policy. It’s crucial to understand the waiting period of the specific policy you’re considering.

- Coverage options: Maternity insurance can be purchased as a standalone policy or as a rider added to a comprehensive health insurance plan. Caution: Be sure to compare the coverage details of both options. Standalone plans might offer more specific benefits for maternity care, while riders might be more affordable but have limitations.

- Planning is essential: Since there’s a waiting period, caution is advised to buy maternity insurance well in advance if you’re planning a family. Ideally, you’d want to purchase the policy before you start trying to conceive.

- Scope of coverage: Carefully review the specific inclusions and exclusions of the maternity insurance plan. Some plans might exclude certain birthing complications or newborn conditions.

- Claim process: Familiarise yourself with the claim process and documentation required by the insurance company. This helps ensure a smooth claims experience.

By being cautious and considering the above factors, you can choose a maternity insurance plan that best meets your needs and provides the necessary financial security during pregnancy and childbirth.

Comments

0 comment