views

Ola Electric IPO: The initial public offering (IPO) of electric two-wheeler company Ola Electric Mobility Ltd has been opened for public subscription on Friday. The IPO will be closed on August 6. Till 4:07 pm on the first day of bidding on Friday, the 6,145.56-crore IPO received a muted 34 per cent subscription, garnering bids for 15,08,32,500 shares as against 44,51,43,490 shares on offer. The IPO was opened at 10 am.

According to the latest data, the retail quota has been fully subscribed and has so far received a 1.56 times subscription, while the non-institutional investors category got a 0.17 times subscription.

The price band of the Ola Electric IPO was fixed at Rs 72-Rs 76 apiece. The share allotment will likely be finalised on August 6, while its listing will take place on both BSE and NSE on August 8.

Ola Electric IPO GMP Today

According to market observers, unlisted shares of Ola Electric Ltd are trading Rs 12.20 higher in the grey market as compared with its issue price. The Rs 12.20 grey market premium or GMP means the grey market is expecting a 16.05 per cent listing gain from the public issue. The GMP is based on market sentiments and keeps changing.

‘Grey market premium’ indicates investors’ readiness to pay more than the issue price.

Ola Electric IPO: Analysts’ Recommendations

Most brokerages are not confident on the IPO and grant the ‘subscribe with caution‘ rating. They advise investors review the company’s prospectus, financial statements, and risk factors before making any investment decisions.

Brokerage firm Swastika in its IPO note gave ‘Neutral‘ rating to the Ola Electric IPO. It said that as a leading player in the Indian EV market, Ola Electric Mobility Ltd (OEML) is developing vertically integrated manufacturing and technological capabilities for EVs and their component parts, such as cells. The company’s business strategy is to seize the potential presented by India’s electrification of transportation and to look for future prospects to export its EVs to specific foreign markets.

“Regarding financial performance, the company has reported a loss for each of the last three fiscal years. The company’s Heavy investment in R&D may not give a return in the immediate future. Due to high competition, it may face downward pricing pressure with that company’s employee attrition rate is too high. The business intends to go into the E-2W bike, three-wheeler, automobile, and—most importantly—the 4680 Li-thion battery market, where it hopes to establish itself as a worldwide center for EV batteries. Although its topline (revenue) has been growing annually, its bottom line (profit) has improved due to lower losses. Undoubtedly, more time will be needed to turn the corner and eliminate the losses,” the brokerage firm said.

“We have a neutral position on this IPO in light of these reasons,” Swastika said in its note.

Another brokerage firm Anand Rathi Research also gave a ‘subscribe with caution‘ rating to the IPO. It said, “Despite being a loss making entity company has gained market share of 34.8 per cent in E2W segment. The company is valued at marketcap/sales of 6.6 times with a market cap of Rs 33,522 crore post issue of equity shares. We believe that the company is richly priced.”

Anand Rathi gave a ‘subscribe for long term’ rating to the IPO with a higher risk appetite.

Geojit Finance Services also remained cautious on the IPO. It said, “Ola Electric’s EV/sales ratio of 7.2 times (FY24) appears expensive. Despite current profitability challenges and valuation concerns, we recommend a ‘subscribe’ rating for high-risk investors with a long-term outlook.”

Ola Electric IPO: More Details

The company’s IPO is a combination of a fresh issue of equity shares up to Rs 5,500 crore and an offer for sale (OFS) of 8.49 crore equity shares worth Rs 645.56 crore, at the upper end of the price band, by promoters and investors. This takes the total issue size to Rs 6,145.56 crore.

Ola Electric Mobility on Thursday mobilised Rs 2,763 crore from anchor investors, a day before its initial share-sale opening for public subscription.

The Bhavish Aggarwal-owned company’s public issue is a widely anticipated IPO among investors, and its market debut next month will be one of India’s biggest IPOs this year. It will also become India’s first-ever EV two-wheeler to list on the bourses.

Investors need to apply for a minimum of 195 equity shares and in multiples thereof. Hence, the minimum investment by retail investors would be Rs 14,820 [195 (lot size) x Rs 76 (upper price band)].

Under the OFS, Ola Electric founder Bhavish Aggarwal would offload almost 3.8 crore shares.

For Ola Electric, the IPO will provide the much-needed impetus to invest in enhancing cell manufacturing capacity and research and development on future technologies and products.

According to its prospectus, Ola Electric Mobility Ltd (OEML) plans to utilise Rs 1,227.6 crore out of the proceeds of its Rs 5,500-crore public issue on capacity expansion of its cell manufacturing plant to 6.4 GWh from 5 GWh.

The company is also looking to use Rs 1,600 crore from the fresh fund on research and product development, another Rs 800 crore will be deployed to repay debts and Rs 350 crore for organic growth initiatives.

In its RHP, OEML said the Phase 1 (a) and Phase 1 (b) of the set up and expansion of the Ola Gigafactory at Krishnagiri district in Tamil Nadu will be funded from internal accruals and long-term borrowings availed by its arm Ola Cell Technologies Pvt Ltd (OCT).

In the details of the objects of the IPO, the company said a portion of the proceeds will be used for capital expenditure to be incurred by OCT for expansion of the capacity of cell manufacturing plant from 5 GWh to 6.4 GWh.

OEML which had on August 15, 2023, announced a line-up of electric motorcycles — Cruiser, Adventure, Roadster and Diamondhead — and expects to begin delivery of the motorcycles in the first half of fiscal 2026.

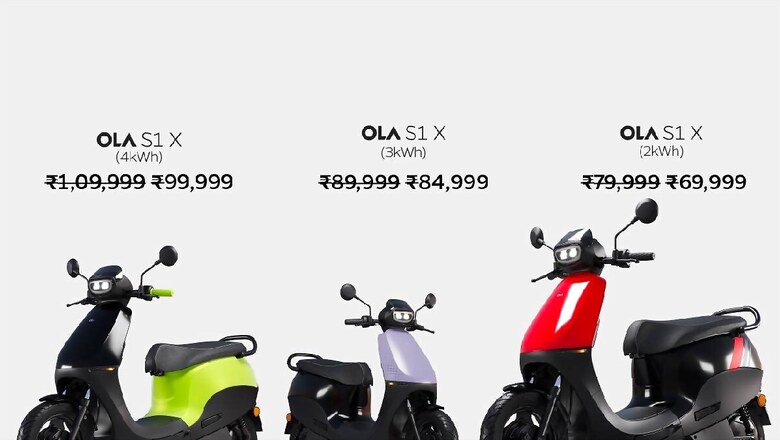

On future product launch plans, the company said, “We plan to further launch affordable mass market Ola S1 models, including E2Ws (electric two-wheelers) targeted at the personal, business-to-business and last-mile delivery segment by first half of fiscal 2025.” It further said, “We also plan to commence delivery of our motorcycles, which we announced on August 15, 2023, by the first half of fiscal 2026. We plan to further expand our product portfolio to also cover mass market motorcycles to capture a broader base of consumers across different product types and price points in the long run.”

Comments

0 comment