views

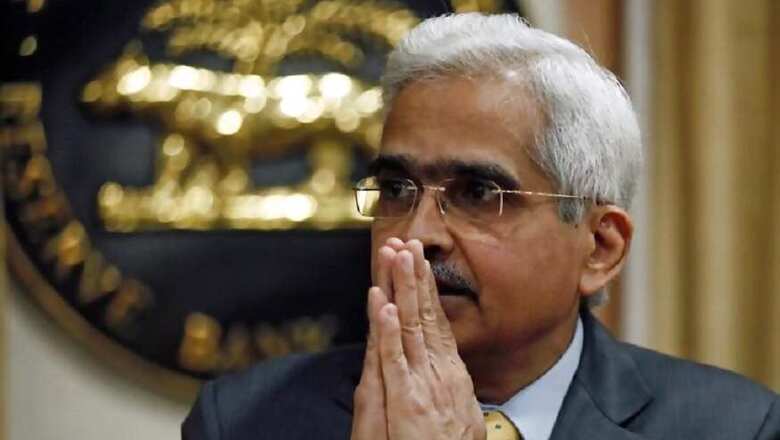

New Delhi: The Governor of the Reserve Bank of India, Shaktikanta Das, on Friday announced a massive 75 basis points cut in repo rates as part of a sslew of measures to counter the economic slowdown caused by the coronavirus pandemic.

This brings the repo rate to the lowest ever at 4.4 per cent from an earlier 5.15 per cent. The reverse repo rate, too, has been cut by 90 basis points to 4 percent.

Das explained that this has been done to make it unattractive for banks to passively deposit funds with the RBI and instead lend it to the productive sectors. Previously, the lowest repo rate was in March 2010 at 4.75 per cent.

The Monetary Policy Committee (MPC), which was scheduled to announce these measures on April 1, preponed their meet in view of the looming economic crisis arising out of the COVID-19 crisis. The MPC voted 4:2 for the rate cut.

Liquidity Adjustment Facility (LAF) has also been cut by 90 bps to 4 per cent.

"RBI has taken up several measures to inject substantial liquidity. Priority is to undertake strong and purposeful action to protect the domestic economy. Need for all stakeholders to fight against the pandemic and banks should do all they can to keep credit flowing," said the RBI Governor.

Besides, Das sounded alarm bells for the oncoming inflation and the possibility of a recession. The outlook for the ongoing financial year will not be released by RBI but projections look negative, he said.

While the apex bank's governor did not divulge growth projections, Moody's slashed India's GDP growth in 2020 to 2.5 per cent.

On Thursday, Finance Minister Nirmala Sitharaman announced a Rs 1.7-lakh crore stimulus package with a slew of measures under the Prime Minister Garib Kalyan scheme.

On October 4, the RBI cut its key lending rate by 25 basis points to 5.15 percent and triggered hopes for cheaper loans during the festival season.

However, on December 5, the RBI maintained status quo for the first time in FY20. All six members of the MPC voted in favour of the pause, leaving the repo rate unchanged at 5.15 percent. The repo rate was lowered by 135 basis points in five back-to-back cuts between February-October 2019.

The RBI was expected to cut the repo rate anywhere between 25-50 basis points due to the ongoing economic slowdown amid a 21-day lockdown to counter the COVID-19 outbreak.

Comments

0 comment